Featured

Table of Contents

Insurance policy business will not pay a minor. Rather, take into consideration leaving the money to an estate or count on. For even more extensive information on life insurance policy get a copy of the NAIC Life Insurance Policy Purchasers Guide.

The IRS places a limitation on just how much cash can go into life insurance policy premiums for the plan and just how promptly such costs can be paid in order for the plan to maintain every one of its tax advantages. If specific restrictions are exceeded, a MEC results. MEC policyholders may undergo tax obligations on distributions on an income-first basis, that is, to the extent there is gain in their policies, along with fines on any kind of taxable amount if they are not age 59 1/2 or older.

Please note that impressive loans accrue rate of interest. Income tax-free therapy also presumes the lending will ultimately be pleased from revenue tax-free survivor benefit proceeds. Finances and withdrawals minimize the policy's money worth and survivor benefit, may create particular policy benefits or motorcyclists to end up being unavailable and may increase the opportunity the plan might gap.

A client may certify for the life insurance, however not the biker. A variable universal life insurance contract is an agreement with the key objective of offering a fatality benefit.

What is a simple explanation of Final Expense?

These portfolios are carefully taken care of in order to please stated financial investment goals. There are costs and fees related to variable life insurance policy contracts, including death and danger costs, a front-end lots, administrative fees, financial investment management fees, abandonment fees and costs for optional riders. Equitable Financial and its associates do not provide legal or tax guidance.

Whether you're starting a family members or obtaining wedded, people normally start to believe regarding life insurance policy when somebody else starts to depend upon their capability to earn a revenue. Which's fantastic, since that's specifically what the survivor benefit is for. Yet, as you discover more regarding life insurance policy, you're likely to find that numerous policies as an example, whole life insurance coverage have greater than simply a survivor benefit.

What are the benefits of entire life insurance? Below are a few of the key things you ought to know. One of the most appealing advantages of acquiring an entire life insurance policy plan is this: As long as you pay your costs, your fatality benefit will certainly never ever end. It is ensured to be paid regardless of when you pass away, whether that's tomorrow, in 5 years, 80 years and even better away. Beneficiaries.

Think you don't need life insurance coverage if you don't have youngsters? There are many advantages to having life insurance, also if you're not supporting a family members.

What is the difference between Estate Planning and other options?

Funeral expenditures, funeral prices and medical bills can include up. Irreversible life insurance coverage is readily available in numerous quantities, so you can choose a death benefit that meets your needs.

Figure out whether term or long-term life insurance policy is ideal for you. Get an estimate of just how much coverage you may require, and exactly how much it can cost. Discover the correct amount for your budget plan and assurance. Locate your amount. As your individual scenarios modification (i.e., marital relationship, birth of a child or task promotion), so will your life insurance policy needs.

For the many component, there are 2 kinds of life insurance intends - either term or permanent plans or some mix of both. Life insurance providers use various forms of term strategies and traditional life policies in addition to "rate of interest delicate" products which have actually ended up being extra prevalent since the 1980's.

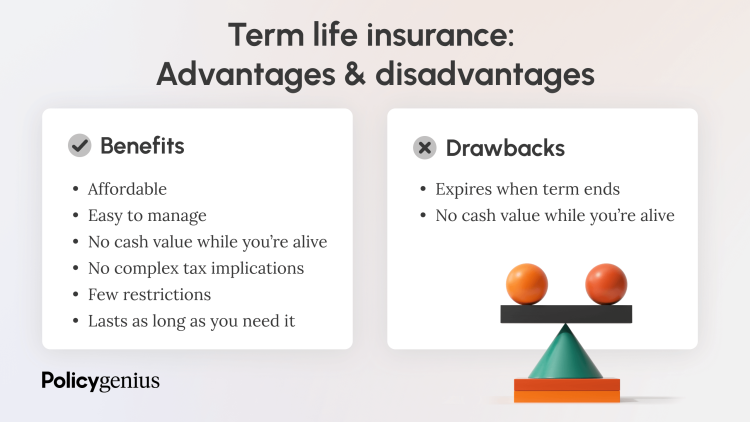

Term insurance coverage provides defense for a specified amount of time. This period can be as short as one year or provide coverage for a specific variety of years such as 5, 10, two decades or to a defined age such as 80 or in some situations up to the oldest age in the life insurance coverage death tables.

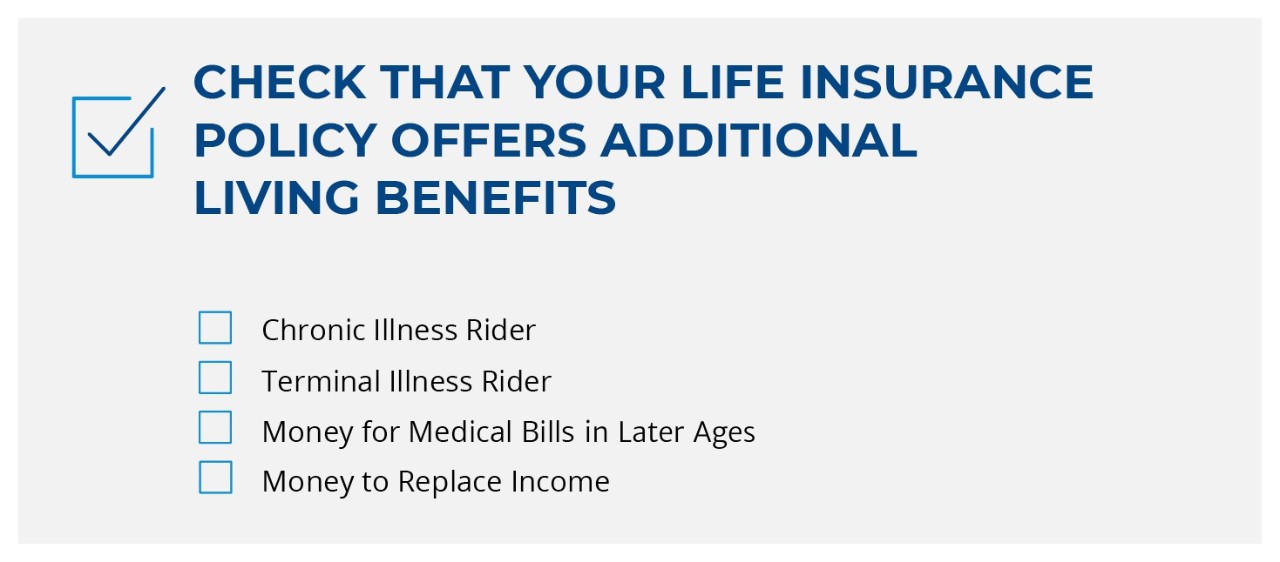

How does Living Benefits work?

Currently term insurance policy prices are extremely affordable and among the most affordable traditionally knowledgeable. It should be kept in mind that it is an extensively held idea that term insurance policy is the least costly pure life insurance policy coverage readily available. One needs to examine the policy terms carefully to decide which term life alternatives are suitable to satisfy your certain conditions.

With each new term the premium is boosted. The right to restore the policy without proof of insurability is an essential benefit to you. Otherwise, the threat you take is that your health might wear away and you may be unable to acquire a plan at the very same prices or perhaps in any way, leaving you and your beneficiaries without protection.

The size of the conversion period will vary depending on the kind of term plan acquired. The premium rate you pay on conversion is usually based on your "present acquired age", which is your age on the conversion day.

Under a degree term policy the face quantity of the policy stays the exact same for the whole period. Often such policies are sold as mortgage security with the quantity of insurance reducing as the equilibrium of the home mortgage reduces.

How do I compare Final Expense plans?

Traditionally, insurers have not deserved to change premiums after the plan is offered. Given that such plans might continue for years, insurers need to utilize traditional death, rate of interest and expense price estimates in the premium computation. Adjustable premium insurance policy, nevertheless, enables insurers to supply insurance at lower "present" premiums based upon much less traditional assumptions with the right to transform these costs in the future.

While term insurance coverage is developed to provide security for a specified period, irreversible insurance coverage is developed to supply insurance coverage for your entire lifetime. To keep the premium rate degree, the premium at the more youthful ages surpasses the real expense of defense. This extra costs builds a book (cash money worth) which assists spend for the policy in later years as the cost of security increases over the premium.

Under some policies, costs are required to be spent for an established variety of years. Under other policies, premiums are paid throughout the insurance holder's lifetime. The insurance provider invests the excess costs dollars This kind of policy, which is sometimes called money worth life insurance policy, generates a savings aspect. Cash values are important to an irreversible life insurance policy plan.

Latest Posts

Burial Insurance In Louisiana

Cheap Family Funeral Cover

Selling Final Expense Insurance