Featured

Table of Contents

- – What is the process for getting No Medical Exa...

- – What is the most popular Level Term Life Insur...

- – Is there a budget-friendly Level Term Life In...

- – How do I apply for Level Term Life Insurance ...

- – Can I get Level Term Life Insurance Quotes o...

- – How long does Level Term Life Insurance Quot...

Adolescent insurance coverage provides a minimum of defense and can offer protection, which may not be offered at a later date. Quantities provided under such insurance coverage are typically restricted based on the age of the youngster. The present restrictions for minors under the age of 14.5 would certainly be the better of $50,000 or 50% of the amount of life insurance in pressure upon the life of the candidate.

Juvenile insurance coverage may be offered with a payor advantage biker, which provides for waiving future premiums on the youngster's policy in the event of the fatality of the individual that pays the premium. Elderly life insurance coverage, in some cases described as rated survivor benefit plans, gives qualified older applicants with very little whole life protection without a medical checkup.

The optimum concern amount of coverage is $25,000. These policies are typically extra costly than a fully underwritten policy if the individual qualifies as a typical threat.

Our term life choices consist of 10, 15, 20, 25, 30, 35, and 40-year policies. One of the most popular kind is level term, meaning your repayment (costs) and payout (fatality advantage) remains level, or the same, till completion of the term period. This is the most uncomplicated of life insurance policy choices and needs very little upkeep for plan proprietors.

What is the process for getting No Medical Exam Level Term Life Insurance?

You might give 50% to your spouse and split the rest amongst your grown-up youngsters, a parent, a friend, or even a charity. Level term life insurance calculator. * In some instances the death benefit may not be tax-free, learn when life insurance coverage is taxable

1Term life insurance policy offers momentary defense for a crucial period of time and is normally much less pricey than irreversible life insurance coverage. 2Term conversion guidelines and restrictions, such as timing, may apply; as an example, there may be a ten-year conversion benefit for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Choice in New York. There is a price to exercise this rider. Not all getting involved policy proprietors are eligible for dividends.

What is the most popular Level Term Life Insurance Companies plan in 2024?

We may be compensated if you click this advertisement. Advertisement Level term life insurance policy is a policy that gives the exact same survivor benefit at any kind of factor in the term. Whether you die on the same day you secure a plan or the last, your recipients will get the very same payout.

Plans can likewise last till specified ages, which in the majority of situations are 65. Past this surface-level details, having a higher understanding of what these strategies involve will assist ensure you acquire a policy that meets your needs.

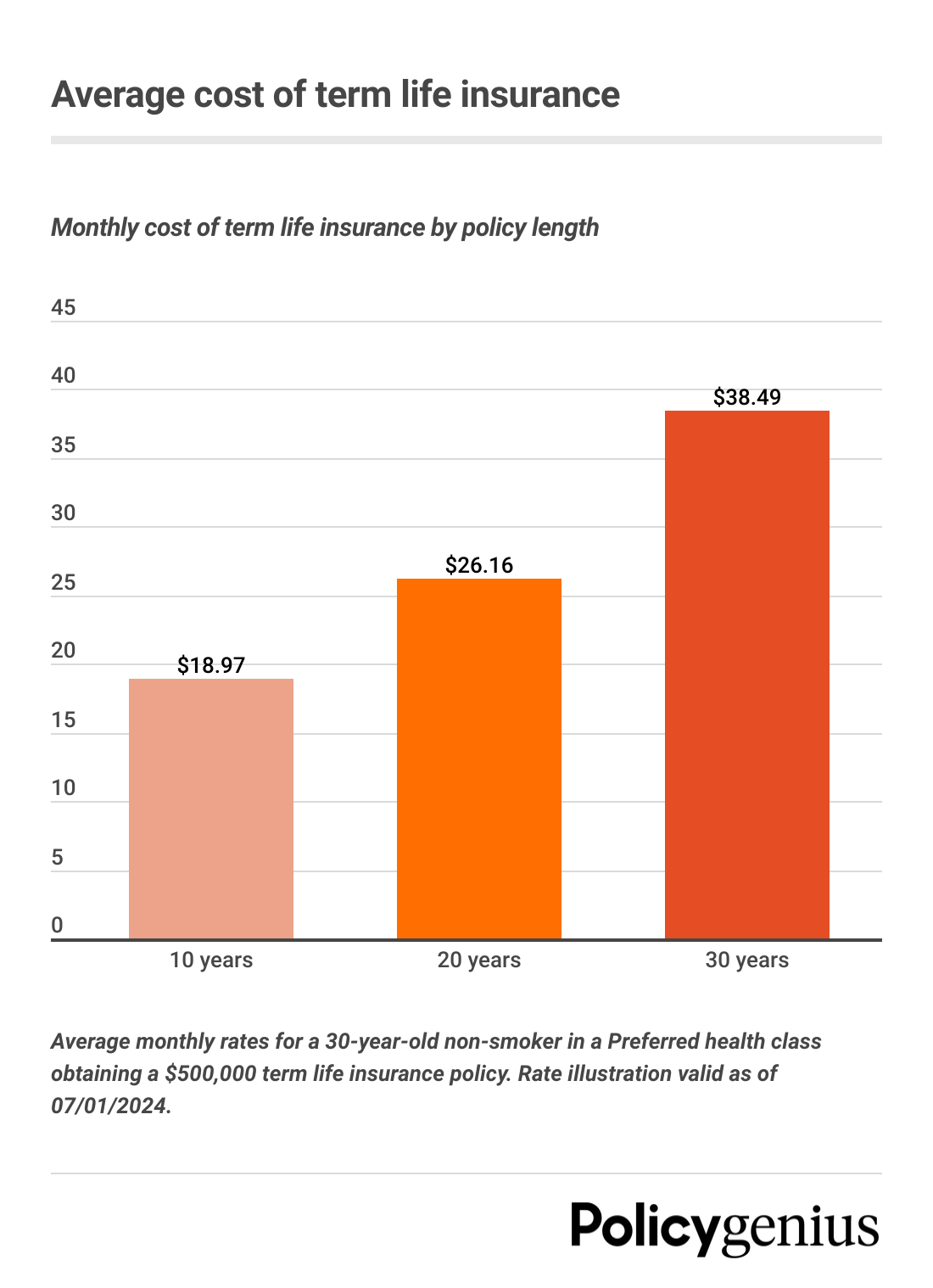

Be mindful that the term you choose will certainly influence the premiums you spend for the policy. A 10-year degree term life insurance coverage policy will cost less than a 30-year policy since there's much less possibility of an occurrence while the plan is active. Lower risk for the insurance company equates to lower premiums for the policyholder.

Is there a budget-friendly Level Term Life Insurance Policy Options option?

Your household's age need to likewise influence your plan term choice. If you have kids, a longer term makes sense since it shields them for a longer time. If your children are near their adult years and will be economically independent in the near future, a shorter term could be a much better fit for you than an extensive one.

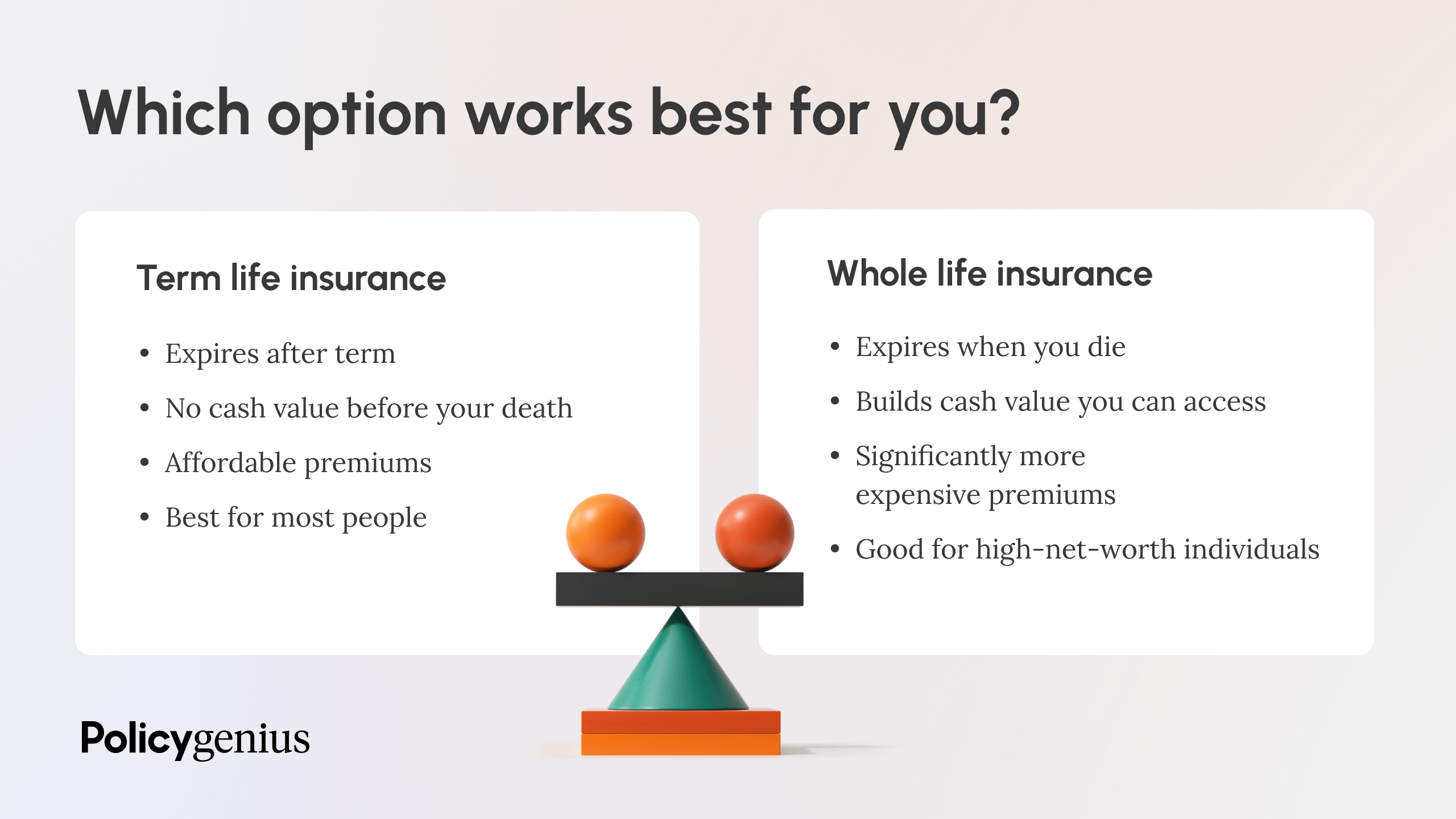

However, when contrasting whole life insurance policy vs. term life insurance policy, it deserves noting that the last typically costs much less than the previous. The result is a lot more protection with reduced costs, providing the very best of both globes if you require a considerable amount of insurance coverage but can not pay for an extra expensive plan.

How do I apply for Level Term Life Insurance Policy Options?

A degree death advantage for a term plan generally pays out as a swelling amount. Some level term life insurance coverage firms permit fixed-period payments.

Interest settlements got from life insurance policies are considered earnings and are subject to tax. When your level term life policy runs out, a couple of various things can happen.

The drawback is that your renewable degree term life insurance will certainly come with higher costs after its initial expiry. We might be compensated if you click this advertisement.

Can I get Level Term Life Insurance Quotes online?

Life insurance policy companies have a formula for computing risk utilizing mortality and passion. Insurance firms have hundreds of customers taking out term life policies at the same time and use the premiums from its energetic policies to pay surviving recipients of other plans. These companies make use of death tables to estimate just how lots of people within a specific team will submit fatality claims per year, which info is utilized to determine ordinary life spans for possible insurance policy holders.

Furthermore, insurance coverage companies can spend the money they obtain from costs and increase their income. The insurance coverage company can invest the money and gain returns - Level premium term life insurance.

The adhering to section information the advantages and disadvantages of degree term life insurance policy. Predictable costs and life insurance policy coverage Simplified plan structure Possible for conversion to long-term life insurance Limited coverage period No cash worth build-up Life insurance policy costs can raise after the term You'll find clear advantages when contrasting degree term life insurance to various other insurance kinds.

How long does Level Term Life Insurance Quotes coverage last?

You constantly know what to anticipate with affordable level term life insurance policy protection. From the moment you secure a plan, your costs will certainly never ever change, helping you prepare monetarily. Your protection won't vary either, making these policies reliable for estate preparation. If you value predictability of your payments and the payouts your heirs will certainly receive, this kind of insurance coverage might be a good suitable for you.

If you go this route, your premiums will certainly increase but it's always great to have some versatility if you desire to keep an energetic life insurance coverage plan. Renewable degree term life insurance is another option worth thinking about. These plans enable you to maintain your present plan after expiration, supplying versatility in the future.

Table of Contents

- – What is the process for getting No Medical Exa...

- – What is the most popular Level Term Life Insur...

- – Is there a budget-friendly Level Term Life In...

- – How do I apply for Level Term Life Insurance ...

- – Can I get Level Term Life Insurance Quotes o...

- – How long does Level Term Life Insurance Quot...

Latest Posts

What is Death Benefits?

How Does What Is A Level Term Life Insurance Policy Work for Families?

Why You Need to Understand Short Term Life Insurance

More

Latest Posts

What is Death Benefits?

How Does What Is A Level Term Life Insurance Policy Work for Families?

Why You Need to Understand Short Term Life Insurance